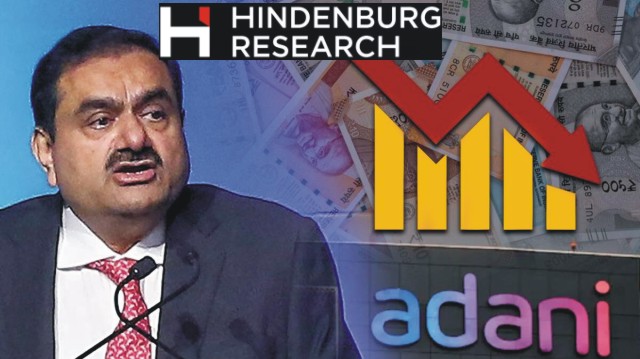

EXACTLY a month ago, Nate Anderson dropped the H-bomb on Adani’s empire. Today, let’s look at the destruction of Adani’s empire caused by eviscerating explosion – how it has made Adani highly contaminated and how his future has been getting darker and how he can or will survive the fallout of the H-bomb.

In September’ 22, Adani was on top of the world before his game, rather his con-game, was revealed. He had a net worth of 148 bn, his highest ever valuation. He also had string of projects coming up both in India and abroad.

From the power supply deal to Bangladesh, to port in Sri Lanka and Israel abroad, to the 4bn coal-PVC plant in Mundra, buying DB power, PTC and several other new projects which were to make him richer still.

But then, the H-bomb was dropped right on Adani’s empire with multiple war heads hitting all his businesses, causing widespread devastation, and resulting explosions, which are wiping out Adani’s wealth every day.

But then, the H-bomb was dropped right on Adani’s empire with multiple war heads hitting all his businesses, causing widespread devastation, and resulting explosions, which are wiping out Adani’s wealth every day.

It has also made him highly radioactive, so contaminated, that nobody outside India wants to do anything with him.

Adani’s bonds are going bust, and several foreign lenders have stopped lending or buying stake in his business.

The destruction is so awesome that Adani’s fortune has fallen from $148 billion to close to $35.5 billion, a loss of $112.5 billion, nearly 9.2 lakh crores.

Also Read: Adani Bubble: A Researched Prick

Adani has lost 3/4th of his net worth from his 52 week high and 70% since the Hindenburg-bomb was dropped. The combined valuation of his companies is also down nearly $160 billion, nearly Rs. 13 lakh crores.

Nobody else in history has lost this much wealth, this fast. The once nearly 300-billion-dollar conglomerate is now worth less than 100 billion USD and there is no end to the fallout of the H-bomb.

A critical milestone will come up next week, when Adani’s net worth might fall to the level of the debt he has taken, approximately 30 billion Dollars, we must wait and watch what happens and how investors react when that happens.

With the LIC now showing the extent of its exposure and the losses it has been making, there will be louder and louder calls for it to exit all its position in Adani group, before Adani goes totally kaput.

With the LIC now showing the extent of its exposure and the losses it has been making, there will be louder and louder calls for it to exit all its position in Adani group, before Adani goes totally kaput.

As an implication, SBI will also be forced to reveal its numbers and its losses. This will force the Government to order an investigation and if they don’t, then supreme court will for sure. It might be the death knell for Adani group.

Also Read: How LIC is robbing the illiterate Indian Blind?

Let me sum up some of the figures for you:

1. Three of Adani’s companies, Adani Gas, Adani Transmission, Adani Green, are down more than 80%+ from their peak valuations. Of these Adani Green and Transmission are already at the implied downside, calculated by Hindenburg report and yet show no signs of the slide stopping, looks like they will get wiped out for good.

2. Their flagship Adani Enterprises, Adani power and their latest baby NDTV are down 65-70%, again with no view of when the crash will stop.

3. By Hindenburg’s calculation, Adani power was to lose only 10%, but it has lost 66%, solid evidence of total loss of investor confidence. Its just an example of Adani’s bad business killing his good businesses.

4. Even their cash cow businesses like Adani Ports are down 43% and Adani Wilmar, a rather successful consumer brand, down 59%, more than the predicted downside of 58% as per H’s report.

Since H-bomb was dropped on Adani, 24th Jan, he has lost nearly $84 billion or 6.8 lakh crores, a crash of 70%.

1. The most terrifying thing about this crash for Adani would be that there is absolutely no visibility on when this crash will end, if at all, and for which companies.

2. From trusted sources inside the business, Bloomberg on Feb 12 reported that “Adani group will now shoot for revenue growth of 15% to 20% for at least the next financial year, down from 40% originally targeted,”.

Lesser profits will lead to a situation where the debt will become unserviceable. This will then further lead to Adani selling his crown jewels for peanuts.

3. This above point is proven in their recent announcement to scrap their plan to buy DB power. Again, the fewer companies he buys, the lesser profits his group can generate. Leading to further difficulties in debt servicing.

4. Adani has even decided against buying PTC, a small company with a valuation of some 400 odd crores. In addition, Orient Cement also called off their partnership with Adani over some complications in land acquisition.

5. Adani has cut Capex plans and is going to slow down expansion and whatever expansion it does, will be through internal cash accruals only as per the group’s announcement.

6. Another one of these upcoming projects by Kutch Copper Limited, one of Adani companies, which was going to build a facility with loan of 6000 crore from consortium of Public funded banks like SBI, BOB and others is under scrutiny now.

7. In a sign of shortage of cash or availability to credit, Adani scrapped building another of his biggest projects, a Coal to PVC plant in Mundra, with an investment of 4 billion USD. This surely is a very bad sign for the future of the group.

8. Worse still, Adani is looking to refinance his loans in the light of ratings downgrades and the investigations of SEBI, which is increasingly under pressure to show that Indian ecosystem can protect the interest of the investors.

9. Adani’s trick of prepaying loans in the hope of distracting investors from the reality of his situation is not working at all. The evidence is that at least 3 or 4 of his stocks have been hitting lower circuits every day for a month now, irrespective of loan prepayment or announcements.

10. Adani has 40 lakh retail shareholders; they have surely lost wealth. Curiously, none of them want to buy any Adani shares, even at the discounted rate of 85%, and neither institutional investor nor foreign investors want to buy any stocks of Adani. Nobody wants to touch the radioactivity of Adani.

Also Read: Hindenburg’s Adani Report Made Simple; Fallout of Exposé

11. The FPO which was bought by big investors at INR 3200 per share has no buyers at INR 1400, which proves that the ‘full FPO subscription’ was scam. We have enough evidence already that FPO was bought through his own shell companies.

Adani was laundering money and using it to inflate his stock price or prevent them from total crash by creating a pretense of investor confidence.

12. However, the worst and scariest thing that could bring about total darkness for Adani is the latest SC ruling in which they refused to accept in a seal cover, a government nominated committee.

SC has expressed its desire to appoint a neutral committee monitored by them to maintain the semblance of fairness. SC has also directed SEBI to find ways to make sure the investor interests are protected.

13. In what could trigger a fresh round of crash is the latest revelation of LIC’s exposure to Adani stock, the losses they made and stake they sold off since the H-report, is a very bad sign for Adani.

When Ambani announced his 70,000-crore investment plan into green energy ecosystem, Adani group through its ANIL, announced an investment of 160,000 crores, those plans will now go into the scrap bin. This is seriously going to hurt India’s ambition on climate goals and sustainable energy.

Adani is into infra, he earns less than what you earn in your savings account, 3.5% and those are capped and regulated. With fewer earnings, smaller and regulated profits, he is going into a situation where he will not be able to service his interest payments, let alone repay the loans.

Adani is into infra, he earns less than what you earn in your savings account, 3.5% and those are capped and regulated. With fewer earnings, smaller and regulated profits, he is going into a situation where he will not be able to service his interest payments, let alone repay the loans.

He surely getting into a situation where it might be impossible for him to raise capital or loans in India or abroad. This leaves him only one choice, he will have to sell his best assets, pay back the loans.

Also Read: The ADANI-JATIN MEHTA Nexus Of Crime Unravels

But if he waits any longer, at lower valuations, he won’t even be able to sell his assets at a price which can help him to pay back his loans.

If the Dear Leader can be pressured into opening a iota of investigation, a proper one, all this could end in jail for Adani. ![]()

___________

Also Read:

TRUTH VS FALSEHOOD: BBC – Who is afraid?

Mughal Gardens – Name Changed, But Why?

Industrialization versus Environmental Degradation

Punjab – How a deadly cocktail of Agri-Water-Energy nexus going to destroy it?

Disclaimer : PunjabTodayTV.com and other platforms of the Punjab Today group strive to include views and opinions from across the entire spectrum, but by no means do we agree with everything we publish. Our efforts and editorial choices consistently underscore our authors’ right to the freedom of speech. However, it should be clear to all readers that individual authors are responsible for the information, ideas or opinions in their articles, and very often, these do not reflect the views of PunjabTodayTV.com or other platforms of the group. Punjab Today does not assume any responsibility or liability for the views of authors whose work appears here.

Punjab Today believes in serious, engaging, narrative journalism at a time when mainstream media houses seem to have given up on long-form writing and news television has blurred or altogether erased the lines between news and slapstick entertainment. We at Punjab Today believe that readers such as yourself appreciate cerebral journalism, and would like you to hold us against the best international industry standards. Brickbats are welcome even more than bouquets, though an occasional pat on the back is always encouraging. Good journalism can be a lifeline in these uncertain times worldwide. You can support us in myriad ways. To begin with, by spreading word about us and forwarding this reportage. Stay engaged.

— Team PT

Copyright © Punjab Today TV : All right Reserve 2016 - 2024 |